A tax assessor's role extends far beyond property tax calculation, profoundly affecting homeowners' financial strategies. Accurate property valuations influence mortgage eligibility and investment decisions. Homeowners should regularly review tax assessor records to track market fluctuations, enabling strategic moves like negotiating sales or improvements. Tax assessors provide insights into real estate dynamics through historical values, market health, assessment methods, and tax policies. Utilizing online platforms allows easy access to data for informed financial planning. Understanding these trends empowers homeowners to adapt to dynamic markets. Tax assessors' appraisals facilitate navigating complex taxes and exemptions, impacting long-term financial health. Proactive review of property appraisals, sales data, and assessment histories aids in strategic financial planning, including investments and tax burden mitigation.

In the intricate financial landscape, understanding the role of a tax assessor is pivotal for homeowners seeking to strategize their financial future. The decisions made by these professionals can significantly influence property values, thereby impacting long-term investment strategies. However, navigating this relationship presents a challenge for many. This article serves as a comprehensive guide, delving into the intricate interplay between tax assessors and homeowners. We’ll explore effective strategies that empower homeowners to make informed choices, leverage financial trends, and ultimately optimize their property investments in light of the valuations set by these authorities.

Understanding Tax Assessor's Role in Homeowner Strategy

The role of a tax assessor goes beyond simply determining property taxes; it significantly influences homeowners’ financial strategies. Tax assessors play a pivotal part in shaping the economic landscape for residents by accurately valuing properties based on market trends and local conditions. This process impacts various aspects of homeownership, from mortgage eligibility to long-term investment decisions. Understanding how tax assessor property records are utilized can empower homeowners to make informed choices.

Tax assessor property records serve as a critical resource for both assessors and homeowners. These records provide detailed information about real estate holdings, including property value, size, location, and recent sales data. Assessors rely on these records to ensure equitable taxation, while homeowners can leverage them to track market fluctuations and potential investment opportunities. For instance, a homeowner considering a sale or refinance can compare their assessed value with local market trends reflected in similar properties’ sales. This empowers them to negotiate effectively and make strategic financial moves.

Expert advice suggests that homeowners should regularly review their tax assessor property records. Changes in assessment, especially unexpected ones, could indicate shifts in the surrounding market. For example, a significant increase in property value might reflect rising real estate demand or development projects in the area. Homeowners can use this information to adjust their financial plans accordingly, whether it’s paying off debt faster or exploring opportunities for home improvement that enhance curb appeal and market value. By staying informed about tax assessor records, homeowners gain a competitive edge in today’s dynamic property market.

Decoding Financial Trends for Effective Planning

Understanding financial trends is a powerful tool for homeowners looking to strategize their property investments effectively. This involves deciphering data hidden within tax assessor records—a crucial resource that provides insights into property values and market dynamics. Tax assessors play an integral role in this process, as they are responsible for appraising and maintaining property records, which serve as the backbone of financial planning. By examining these records, homeowners can uncover valuable information about their neighborhood’s real estate trends, enabling them to make informed decisions.

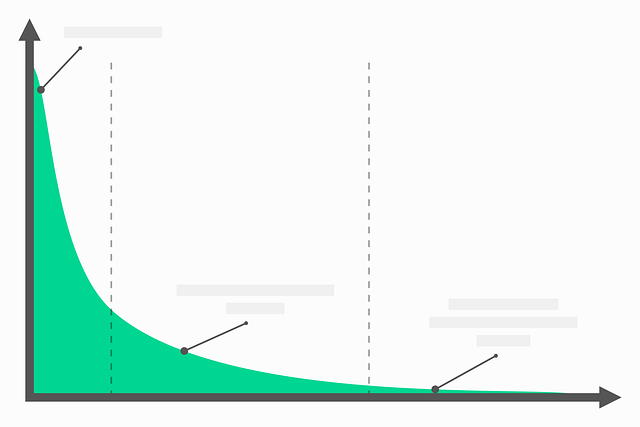

For instance, tax assessor property records offer a comprehensive view of historical property values, which is essential for gauging the health of local markets. This data allows homeowners to identify rising or declining property values in specific areas, aiding in strategic planning. For example, a homeowner considering a sale might use these trends to time their move optimally, benefiting from a favorable market. Conversely, investors can analyze depreciation rates to identify undervalued properties with potential for growth. Tax assessor records also capture changes in assessment methods and local tax policies, providing context for financial projections.

Practical advice for homeowners includes regular review of these records, especially when significant changes occur in the neighborhood or during major market shifts. Utilizing online platforms provided by tax assessors is a simple yet effective method to access this data easily. Homeowners should focus on comparing property values over time, studying sales trends, and noting any anomalies. This analysis empowers them to adapt their financial strategies, ensuring they remain ahead of the curve in an ever-evolving real estate landscape. By decoding these financial trends, homeowners can make informed choices, ultimately enhancing their long-term financial health.

Leveraging Assessments for Optimal Property Value

Tax assessors play a pivotal role in shaping homeowners’ strategies by providing crucial insights into financial trends. One of their primary functions is to evaluate and determine property values, which significantly influences how owners approach their financial decisions. By leveraging the expertise of tax assessors and understanding the data they provide, homeowners can optimize their property’s market position. This process begins with accessing public property records, a treasure trove of information maintained by local tax assessor offices.

Property record analysis offers homeowners a strategic advantage. Tax assessor data reveals market trends, neighborhood dynamics, and comparable sales, all of which are essential for setting an accurate property value. For instance, homeowners can track assessment history to identify patterns and make informed decisions about renovations or improvements that enhance their home’s appeal and value. According to recent studies, areas with transparent tax assessor records often experience more efficient real estate markets, benefiting both buyers and sellers.

Furthermore, tax assessors’ professional appraisals help homeowners navigate complex property taxes and potential exemptions. By staying informed about assessment methodologies and local regulations, owners can challenge inaccurate valuations, save on taxes, or take advantage of available incentives. Regularly reviewing tax assessor property records allows homeowners to stay abreast of neighborhood developments and market fluctuations, empowering them to make strategic financial moves that align with their long-term goals.

Navigating Tax Implications: Strategies for Homeowners

Navigating Tax Implications: Strategies for Homeowners

Understanding how a tax assessor’s decisions can significantly impact your financial strategy is crucial for homeowners. Property taxes are a substantial component of homeownership costs, and effective navigation of these implications can lead to considerable savings or avoid costly mistakes. The tax assessor’s role in determining property values directly influences the tax rates homeowners pay, making it an essential aspect to consider when planning long-term financial moves.

Tax assessors base their evaluations on various factors, including location, market trends, and property characteristics detailed in public records. Homeowners can gain valuable insights by reviewing these records, such as property appraisals, sales data, and tax assessment histories. For instance, analyzing recent sales of comparable properties within the same neighborhood can provide a good understanding of market values. This proactive approach allows homeowners to identify any discrepancies or potential overvaluations, enabling them to challenge their assessed values if necessary.

Implementing strategic financial planning requires staying informed about local tax laws and assessment practices. Regularly updating your knowledge on these matters ensures you’re prepared for reassessments, which can occur periodically based on market fluctuations. For example, a booming real estate market might result in higher property assessments, impacting your tax liability. Staying ahead of such changes can help homeowners make informed decisions regarding investments, mortgage refinancings, or strategic selling to mitigate potential tax burdens.